Welcome to Finance 360

Know Where Your Money Flows & Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Welcome to Finance 360

Know Where Your Money Flows &

Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

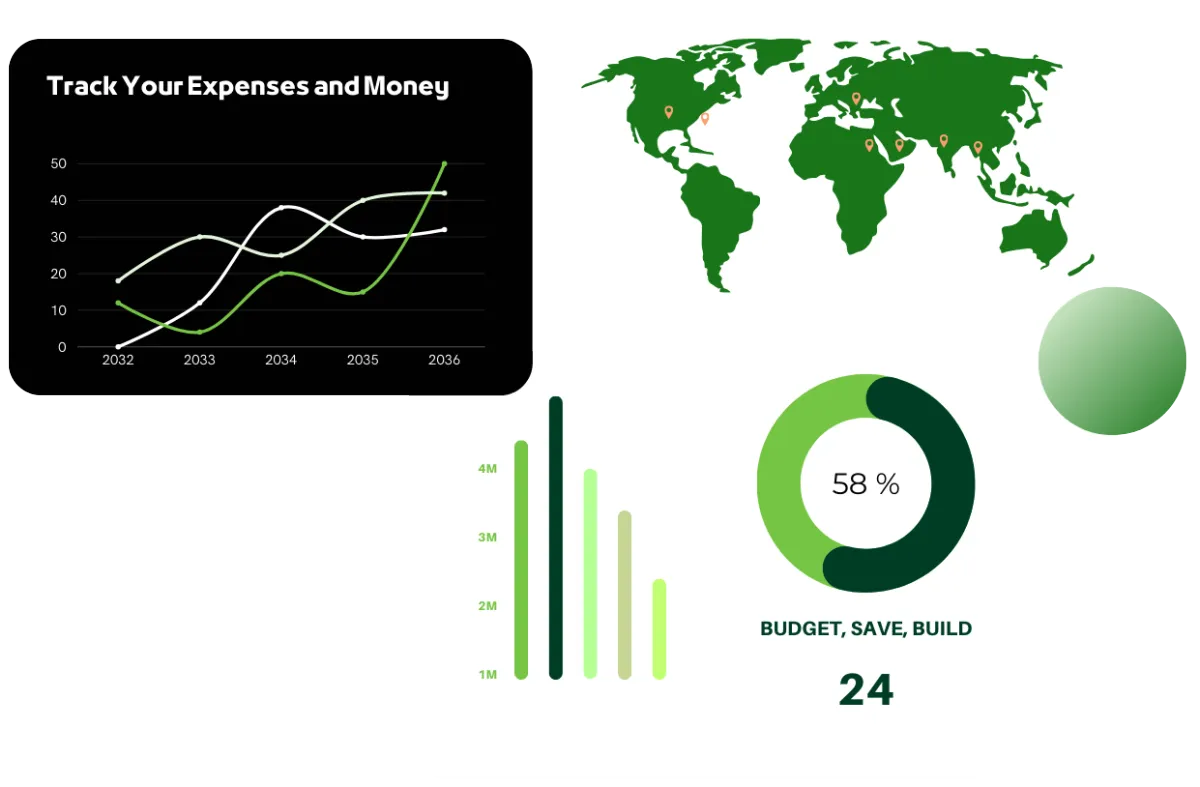

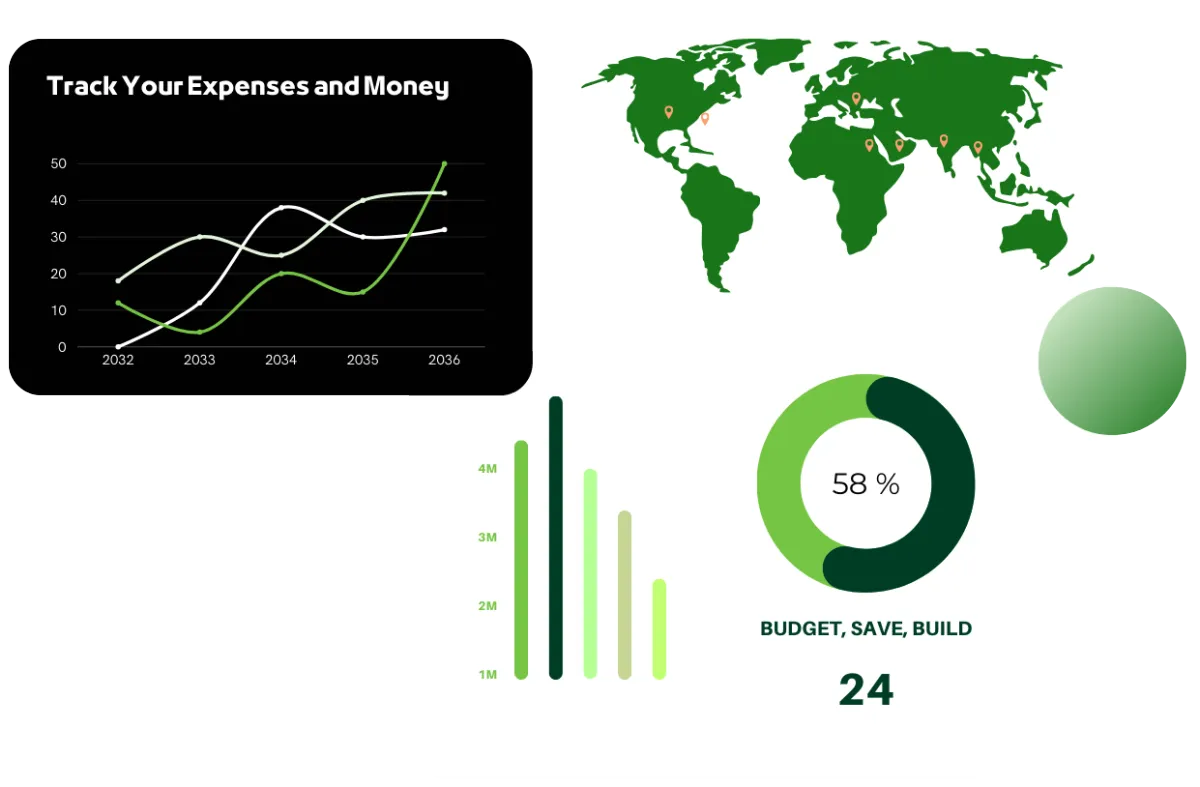

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

Our 8 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING

& SAVINGS

Building a Strong Financial Foundation

TAX

PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE

PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter financial choices.

Our 7 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING & SAVINGS

Building a Strong Financial Foundation

TAX PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter

financial choices.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

Why Emergency Funds Matter More Than Ever in 2025

Let’s be real. Life doesn’t wait. The rent’s due. It’s never when you’re ready. It’s always when rent is due, the fridge is empty, and your kid just outgrew their sneakers. Groceries are higher than ever. Your car’s making that weird sound again, and of course, the air conditioner picks July to stop working.

We’ve all been there. And if you’ve ever had to swipe a credit card just to stay afloat, you know the stress that follows.

Why Emergency Funds Matter More Than Ever

Here’s the tough truth: According to Bankrate, 59% of Americans couldn’t handle a $1,000 emergency without going into debt. And nearly 40% say even $400 would throw them off financially as per CBS News.

This isn’t a budgeting issue but a survival issue. Inflation, rising rent, and medical costs don’t wait until you’re “ready.” The unexpected shows up whenever it wants, and it hits harder when you don’t have a safety net.

That’s why emergency funds matter. They’re not just about saving money. They’re about buying peace of mind.

How Much Should You Really Have Saved?

Think of it like this:

A good starting point is around $2,000. It won’t cover everything, but it’s enough to keep a flat tire or medical bill from throwing off your whole month.

Most experts recommend saving enough to cover 3–6 months of essential expenses such as rent, food, bills, transportation.

If your income isn’t steady, or you’ve got kids or dependents, it’s smart to aim higher. 6 to 12 months gives you more breathing room.

In today’s economy, that might mean having somewhere between $20,000 and $35,000 tucked away. Sounds like a lot? It is. But most people don’t save that overnight. They build it little by little, $50 here, $100 there, until that fund becomes a real safety net.

How Do You Actually Build One?

Saving for emergencies doesn’t have to be overwhelming. Start small, stay consistent, and keep it simple:

Pick a number you can stick to, even $25 or $50 a week is a win

Automate it so the money moves into savings without you thinking about it

Use extras like tax refunds, bonuses, or side hustle income to grow your fund faster

Don’t stress if you use it. That’s the whole point. Just refill it when you can.

The goal isn’t to be perfect. It’s to be prepared. And every dollar you set aside gets you closer. Life’s full of surprises. When life throws a curveball, your emergency fund is the glove. It gives you options. It keeps you calm. And it reminds you: you’ve got this.

And honestly? That kind of peace is worth every dollar. You don’t need to be rich to have financial peace. You just need a plan, and the courage to start.

Take Control with Finance360

You don’t have to do this money thing solo. If saving feels impossible, bills are sneaking up, or you’re stuck in the boring budget spiral, Finance360’s got your back.

Think of us as your on-demand money squad:

Real experts, real fast: Connect with advisors, tax pros, estate attorneys via call, chat, or even IRL when you need backup

7 pillars, total coverage: From saving and budgeting to retirement, insurance, debt, taxes, healthcare, and estate planning

Tools that actually help: Goal-based savings, easy expense tracking, personalized reports, ebooks, worksheets, and a 24/7 Care Team so you're never in the dark

This isn't just another app. It's like having a financial coach, a calendar, a smarter wallet, and a wellness guide, all in your pocket.

"Start your financial journey today with Finance 360!"

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users

For Ios Users

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users