Welcome to Finance 360

Know Where Your Money Flows & Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Welcome to Finance 360

Know Where Your Money Flows &

Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

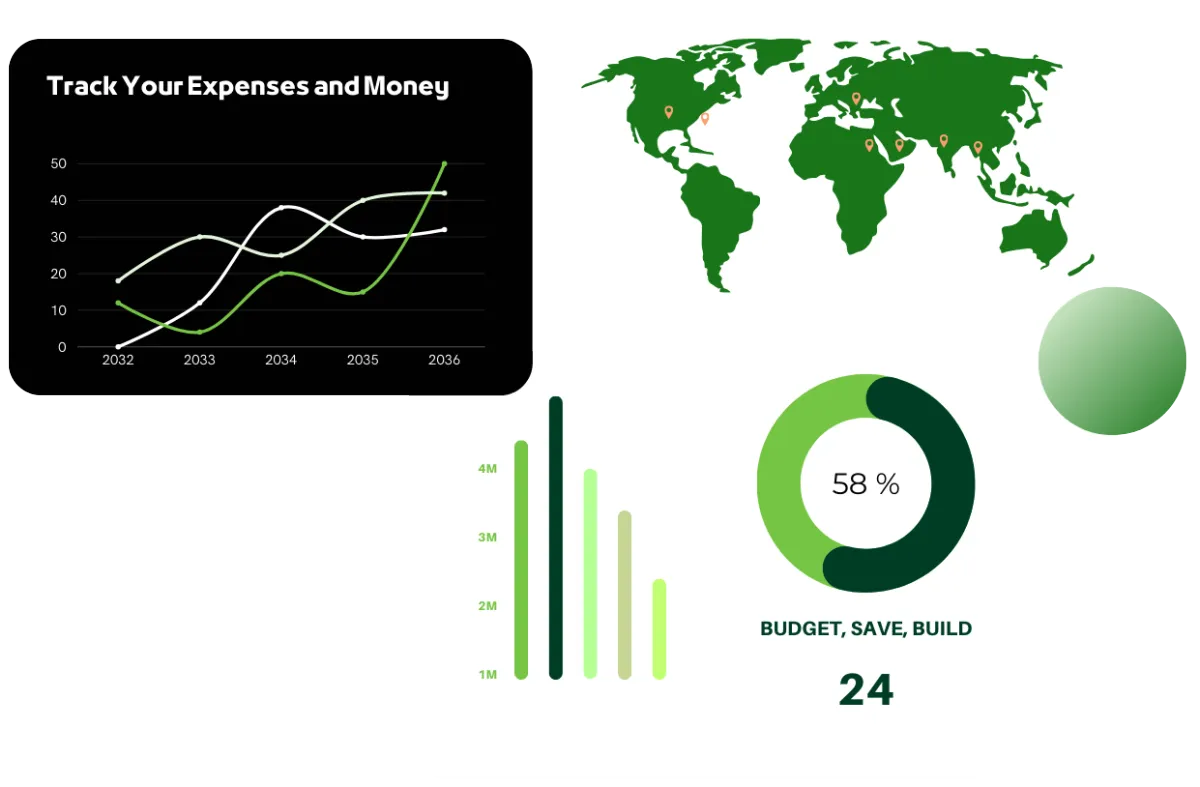

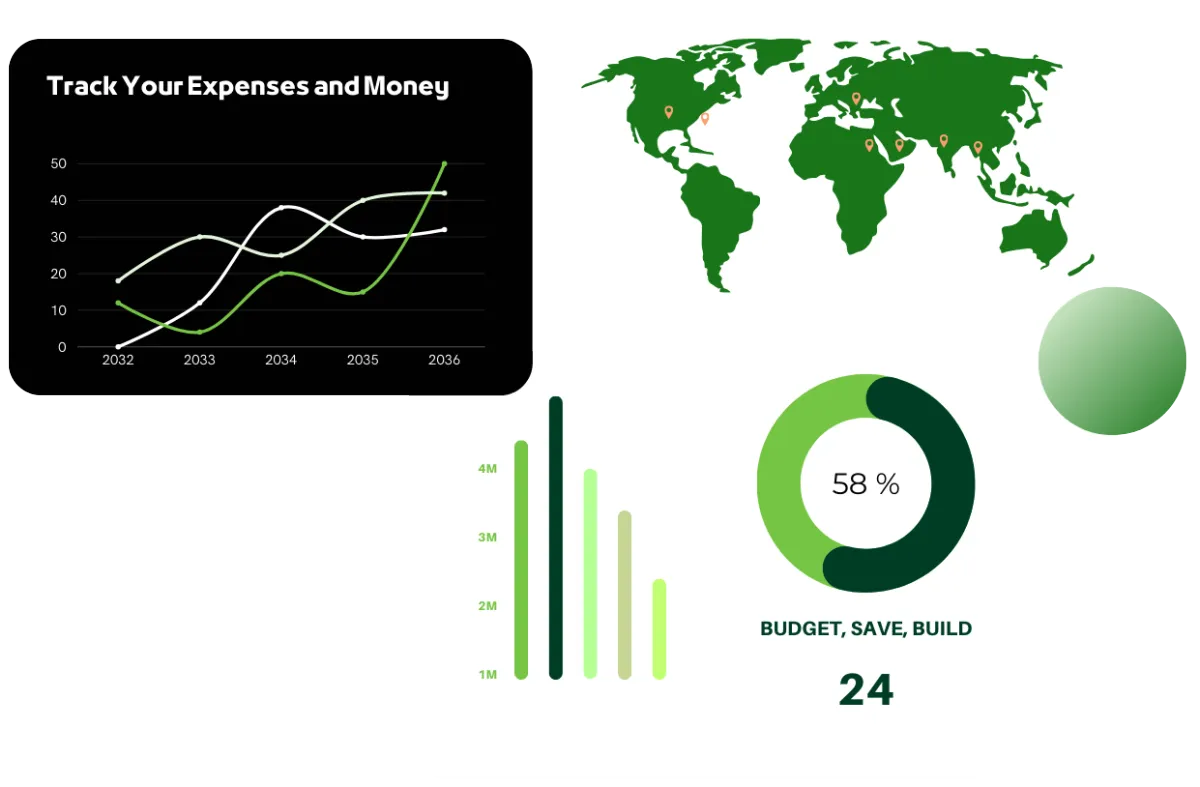

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

Our 8 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING

& SAVINGS

Building a Strong Financial Foundation

TAX

PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE

PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter financial choices.

Our 7 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING & SAVINGS

Building a Strong Financial Foundation

TAX PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter

financial choices.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

How to Set Realistic Financial Goals and Build a Better Money Future

"Your budget is the bridge between where you are and where you want to be."

Setting financial goals is an essential step to improving your money management and securing a better future. By being realistic, you can create goals that are achievable and keep you motivated throughout the year. Here’s a simple guide to help you set and stick to your financial goals.

1. Assess Your Current Financial Situation

Take a good look at your income, expenses, savings, and debts. Knowing where you stand helps you understand what’s possible and prioritize areas for improvement.

2. Define Clear and Specific Goals

Instead of saying, “I want to save money,” be specific: “I want to save $5,000 this year for an emergency fund.” Clear goals give you direction.

3. Make Your Goals Measurable

Add numbers and timelines to your goals. For example, “Pay off $2,000 of credit card debt by December” is measurable and lets you track progress.

4. Prioritize Your Goals

Not all goals can be tackled at once. Decide which are most important, like paying off high-interest debt or building an emergency fund.

5. Break Goals into Smaller Steps

Divide big goals into smaller tasks. For instance, if your goal is to save $5,000 in a year, aim to save $417 each month.

6. Track Your Progress Regularly

Set aside time each month to review your goals. Celebrate small victories to stay motivated.

7. Be Flexible

Life can be unpredictable. If something changes, adjust your goals without giving up.

By following these steps, you can create realistic financial goals that set you up for success. Remember, consistency is key, and even small steps can lead to big achievements over time.

"Start your financial journey today with Finance 360!"

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users

For Ios Users

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users