Welcome to Finance 360

Know Where Your Money Flows & Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Welcome to Finance 360

Know Where Your Money Flows &

Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

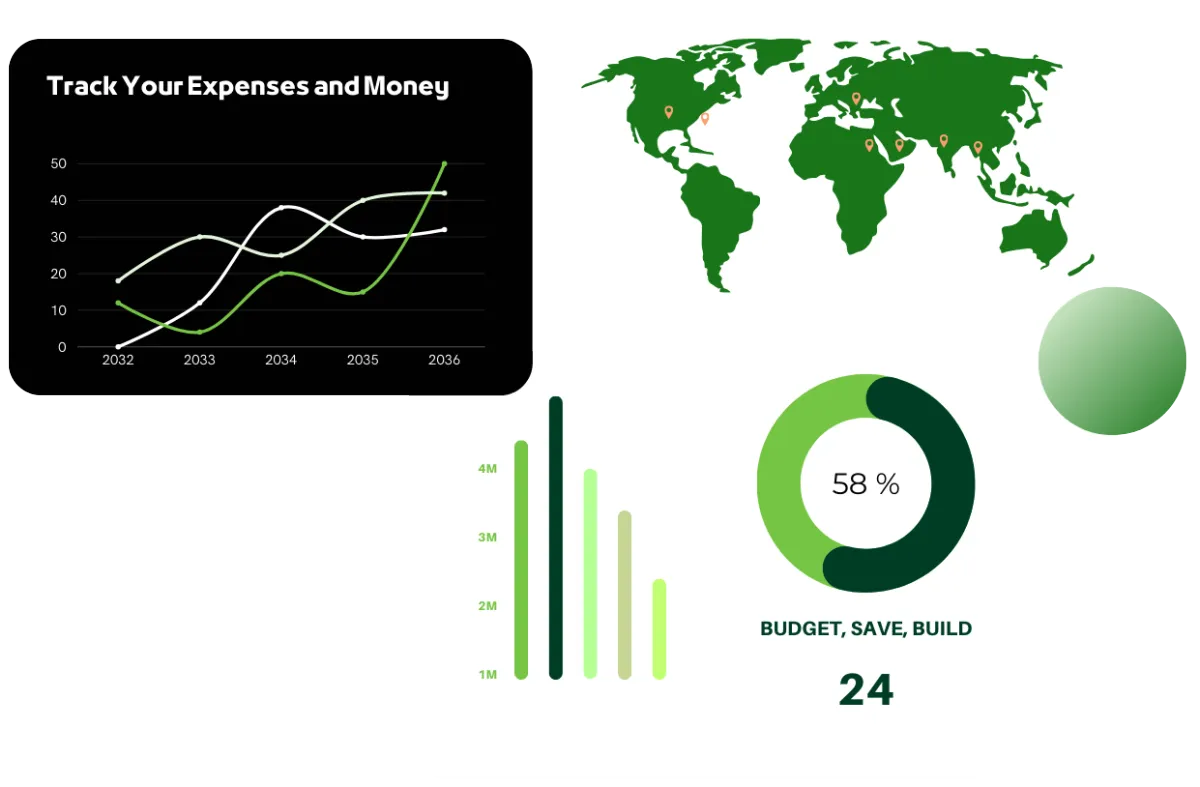

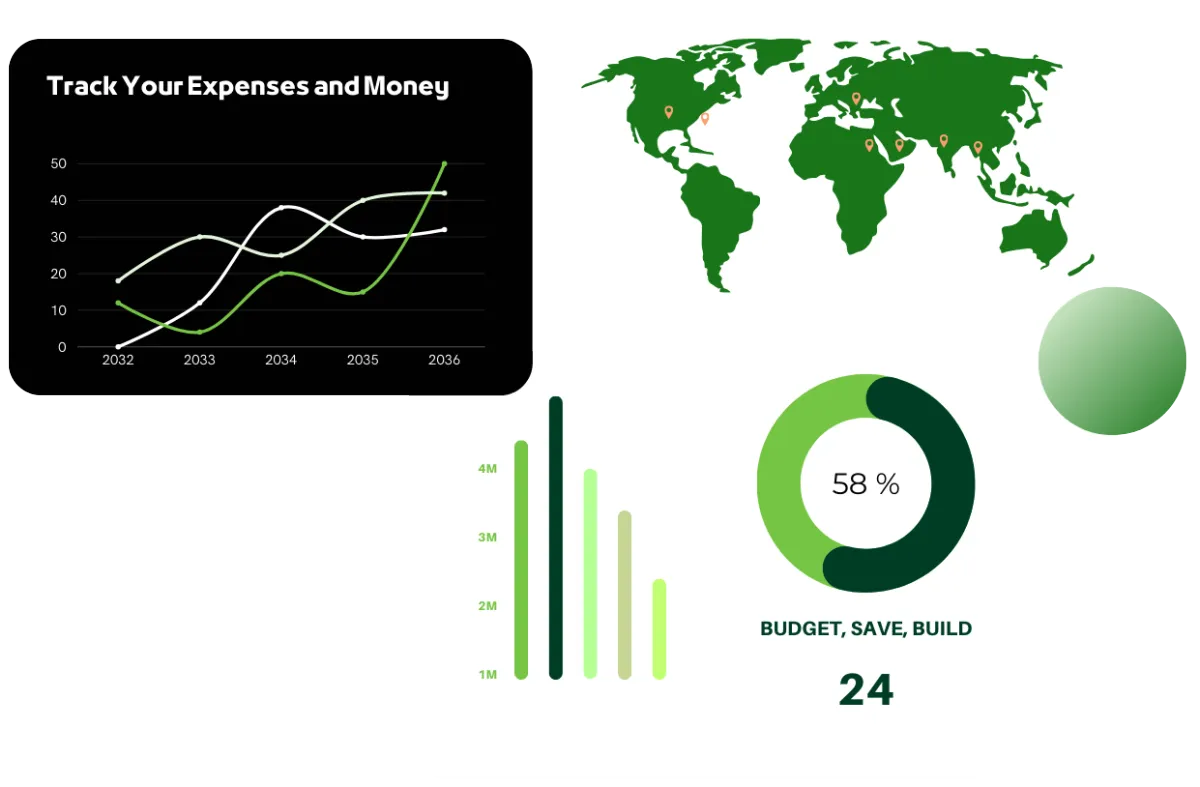

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

Our 8 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING

& SAVINGS

Building a Strong Financial Foundation

TAX

PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE

PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter financial choices.

Our 7 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING & SAVINGS

Building a Strong Financial Foundation

TAX PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter

financial choices.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

Spend Smarter, Not Less: Simple Tips to Master Your Money and Boost Savings

"It's not how much you spend, it's how wisely you spend that makes all the difference."

When it comes to managing your money, it’s easy to think that the solution is simply to spend less. But the truth is, it’s not about spending less—it’s about spending smarter. Here are some easy tips to help you make better financial decisions without feeling restricted.

1. Track Your Spending to Understand Your Money Flow

Before you can spend smarter, you need to know where your money is going. Use budgeting apps or simple spreadsheets to track every expense for at least 30 days. This awareness reveals spending patterns and highlights areas where you might be overspending on unnecessary items.

2. Prioritize Spending on What Truly Matters

Evaluate your spending based on your values and long-term goals. It might mean investing more in your health through quality food and fitness or dedicating funds to professional development or education. Prioritizing ensures your money works toward enhancing your quality of life and future security.

3. Hunt for Deals, Discounts, and Cashbacks

Being a savvy shopper isn’t about being cheap—it’s about getting the best value. Use price comparison tools, sign up for store newsletters, and take advantage of cashback offers. Small savings here and there can compound into significant amounts over time.

4. Create a Realistic Budget and Stick to It

Budgeting is a cornerstone of smart spending. Set clear, achievable budget categories aligned with your income and goals. This proactive planning helps curb impulse purchases and keeps you financially disciplined.

5. Build an Emergency Fund and Save Consistently

Unexpected expenses happen—car repairs, medical bills, or job loss. Having an emergency fund with 3-6 months’ worth of expenses safeguards your financial stability. Additionally, consistently saving, whether for retirement or other goals, leverages the power of compound interest to grow your wealth.

6. Avoid Debt Traps by Spending Wisely

Smart spending also means steering clear of high-interest debt whenever possible. If you carry credit card debt, focus on paying it down quickly, as interest charges can erode your financial progress. Use debt strategically, such as for investments or necessary expenses, but avoid unnecessary borrowing.

7. Automate Your Finances for Consistency

Set up automatic transfers to your savings accounts and bill payments. Automation reduces the risk of missed payments and helps you stay on track with your budgeting and saving goals effortlessly.

8. Regularly Review and Adjust Your Financial Plan

Your financial situation and goals can change over time. Make it a habit to review your budget, spending habits, and savings progress every few months. Adjust your plan as needed to stay aligned with your evolving needs.

Final Thoughts: Take Control and Start Spending Smarter Today

Spending smarter is a mindset—a commitment to making intentional, informed decisions about your money. By tracking your spending, prioritizing what matters, hunting for deals, budgeting, saving, and avoiding debt, you empower yourself to build a stronger financial future.

"Start Spending Smarter Today! Get Expert Tips with

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users

For Ios Users

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users