Welcome to Finance 360

Know Where Your Money Flows & Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Welcome to Finance 360

Know Where Your Money Flows &

Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

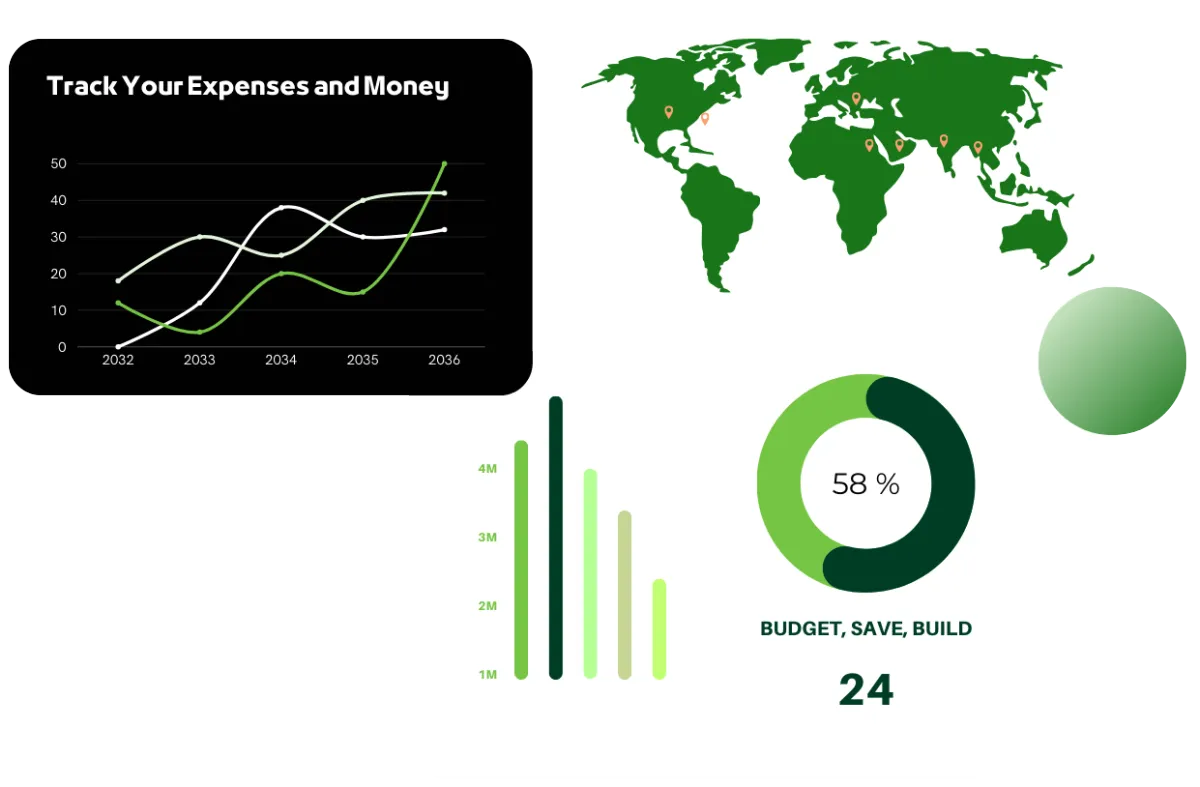

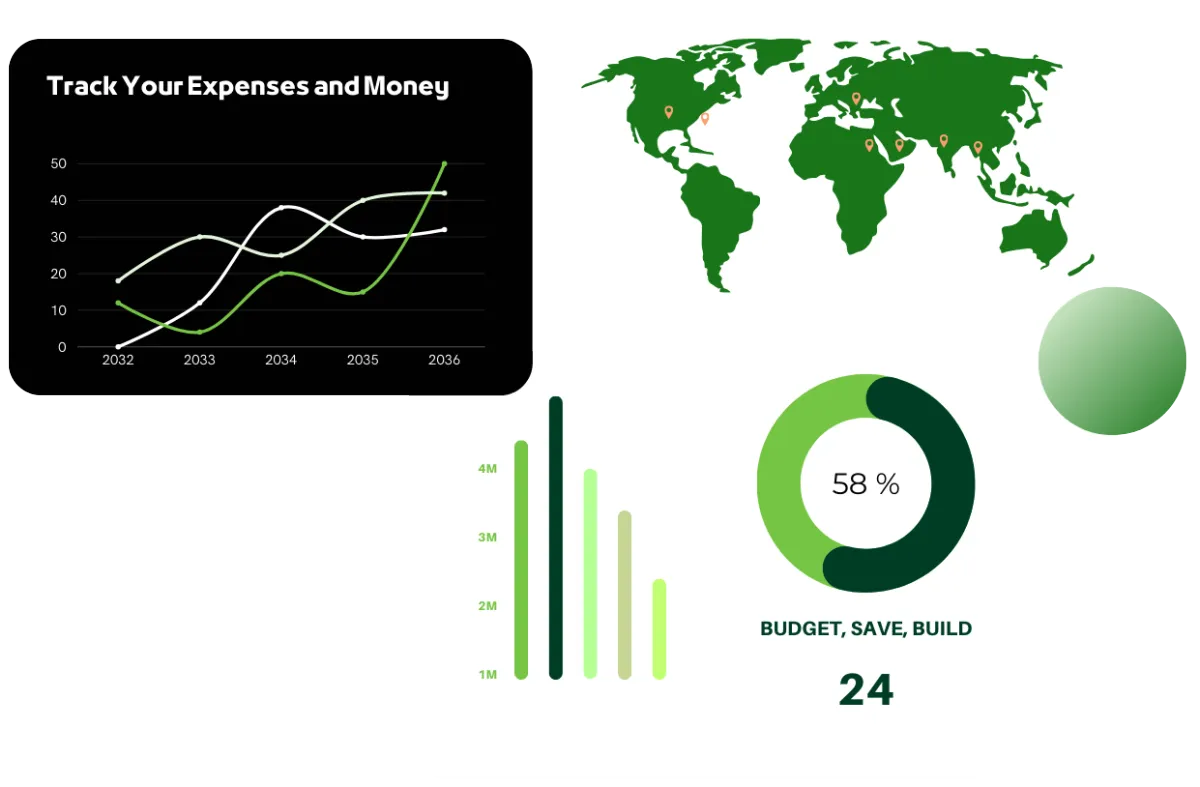

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

Our 8 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING

& SAVINGS

Building a Strong Financial Foundation

TAX

PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE

PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter financial choices.

Our 7 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING & SAVINGS

Building a Strong Financial Foundation

TAX PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter

financial choices.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

Why We Overspend When We’re Stressed (and How to Stop)

You come home exhausted, nerves frayed from the chaos of the day, and somehow, you're drawn to your favorite shopping app. “Just one thing,” you whisper. A small indulgence. A reward for enduring. But as the cart fills, so does the quiet guilt. You’ve been here before.

You're not alone.

A recent CNN survey found that 71% of Americans identify money as a significant cause of stress. And when we’re anxious, we don’t always reach for logic, we reach for relief. A new pair of shoes. A shiny tech gadget. Something, anything, to help us feel in control again.

But this isn’t carelessness. It’s survival. Emotional spending is often less about excess, and more about escape.

And the moment we see it for what it truly is, we can begin to reclaim our power, one choice at a time.

The Psychology of Impulse

“Doom spending.” It sounds dramatic, but it’s a real term.

Experts at Very Well Mind define it as spending money in response to anxiety or stress about the future, buying things to feel better, even when you know it’ll probably hurt later.

According to a study by Intuit Credit Karma, 27% of Americans say they’ve done exactly that, spent money to cope with stress. And 40% say they’re doing it more than they did a year ago (Source: Vice)

Why does it happen?

When we’re anxious about the future, our brains tend to imagine the worst. Dr. Christopher Fisher, director of outpatient psychiatry at Northwell Zucker Hillside Hospital, says the body reacts like the danger is already here. Your heart races, your thoughts speed up, and you just want something to feel better fast. For a lot of people, that “something” is spending. (Source: Very Well Mind)

It’s not a plan, but a reaction. In that moment, comfort feels more important than logic. But after the buy button comes the crash: guilt, regret, and sometimes even debt.

The Regret That Follows the Receipt

Buying something to lift your mood can feel harmless in the moment. A quick pick-me-up. But for many people, those small purchases stack up, fast.

By the end of 2024, Americans carried over $1.21 trillion in credit card debt, according to the New York Federal Reserve. (Source: CNBC)

That’s not just a number, but also the pressure behind sleepless nights, minimum payments, and missed goals.

A Clever Real Estate Survey revealed that:

74% of Americans say they struggle with overspending

45% have literally cried over their spending choices

And 1 in 6 say their spending habits ruined their lives

This isn’t just about budgeting. It’s about how we cope.

Spending under stress isn’t a character flaw. It’s a warning sign. And when we ignore it, the emotional cost runs deeper than the financial one.

So What Can You Do?

You don’t need a spreadsheet. You need self-awareness and small, protective habits:

Notice your triggers – After work? Late nights? Right before payday?

Delay the impulse – Wait 24 hours. Most cravings fade.

Replace the ritual – Walk, journal, breathe. Don’t shop.

Unsubscribe and uninstall – Protect yourself from temptation.

Start small – Save $20 instead of spending $200. Control is built, not bought.

You’re Not Alone

Even when you feel ashamed, especially then, remember this:

You’re not bad with money. You’re just trying to self-soothe.

But now, you’re doing it with awareness, and that’s the first step toward lasting change.

Ready to Take Back Control?

Explore how Finance 360 can help you reset your habits, reduce financial stress, and build lasting confidence with your money.

"Start your financial journey today with Finance 360!"

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users

For Ios Users

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users