Welcome to Finance 360

Know Where Your Money Flows & Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Welcome to Finance 360

Know Where Your Money Flows &

Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

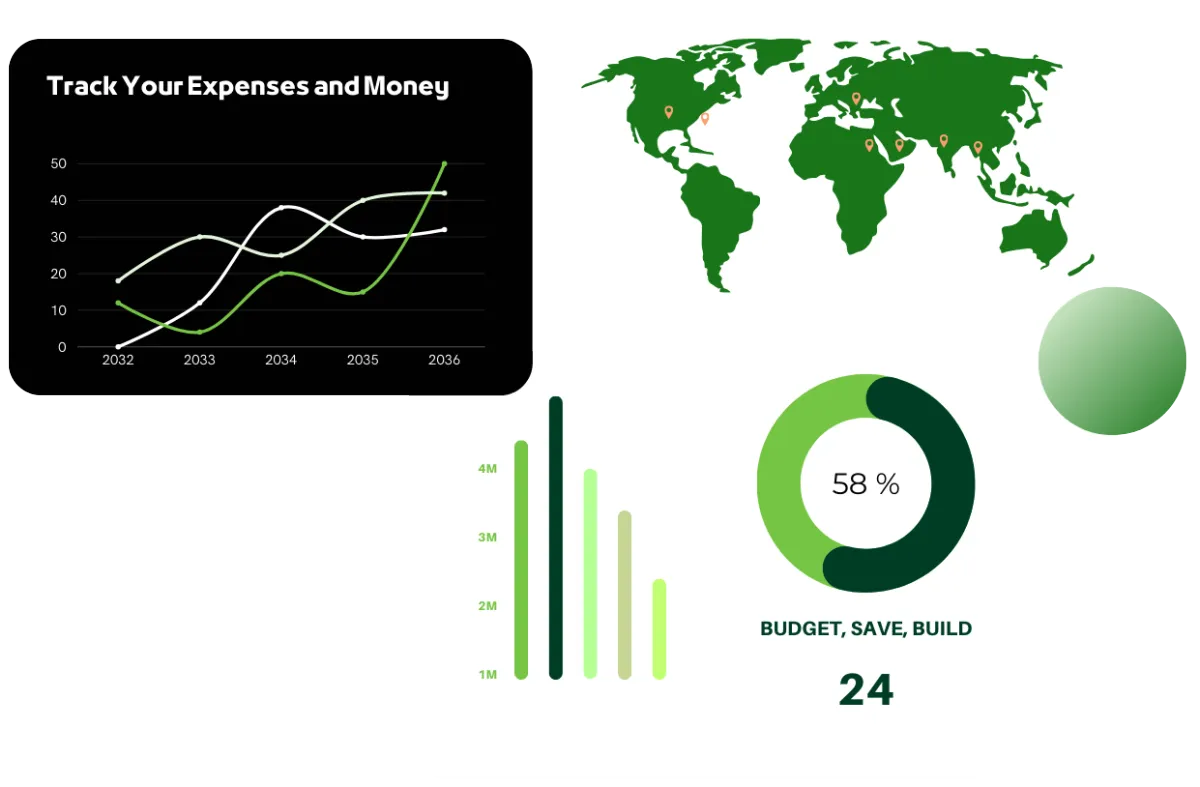

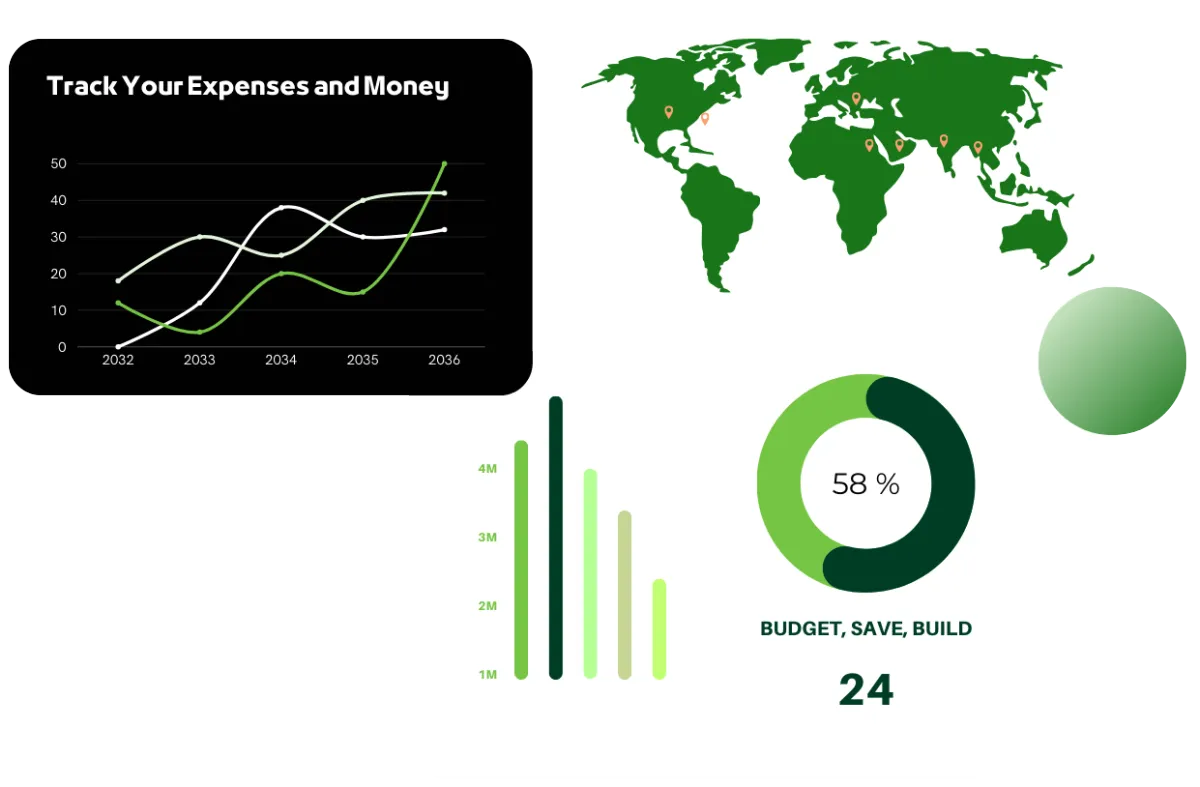

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

Our 8 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING

& SAVINGS

Building a Strong Financial Foundation

TAX

PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE

PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter financial choices.

Our 7 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING & SAVINGS

Building a Strong Financial Foundation

TAX PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter

financial choices.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

How to Outsmart Inflation in 2025: Real Budget Tips to Save More Money

“It’s not that you’re bad with money, everything just got more expensive while your paycheck stayed the same.”

If you’ve opened your fridge lately and sighed at the cost of eggs (again), you’re not alone. Americans are getting hit from every direction, rent, groceries, gas, even the “cheap” stuff like dollar menus aren’t dollar-anything anymore.

According to the U.S. Bureau of Labor Statistics, the Consumer Price Index is still over 17% higher than it was in 2021. Groceries are up more than 23% (FRED) and wages? Still struggling to keep up.

So, what do you do when life costs more than your income?

You fight back, with intention, with tools, and with superior strategies.

Budget Like It’s a Survival Game

This isn’t about cutting out lattes or switching to off-brand toothpaste. It's about prioritizing what actually matters and putting your dollars where they count most.

Start with a “Must-Survive” Budget

Housing, utilities, food, insurance non-negotiables come first. Build your budget backward from there.Use a Realistic Spending Tracker

If you don’t know where your money goes, it’s already gone. Use tools like Finance360’s Budget Worksheets to see the truth in black and white.Embrace Zero-Based Budgeting

Every dollar gets a job. Whether it’s rent, Netflix, or that emergency tire fund, assign it before you spend it.

"Hope is not a strategy."

Neither is winging your budget.

Outsmart the Price Hikes with Micro-Wins

Buy groceries based on unit price, not brand loyalty

Generic rice that’s $0.49/lb wins over the name-brand “jasmine-scented gourmet fluff” at $2.09/lb. Every time.Plan around what’s on sale, not what you crave

Think: what can I make with what’s cheapest this week? Not what do I feel like eating?Negotiate everything

From internet bills to rent renewals. You’d be surprised how often a polite “Is this the best you can do?” saves you real money.

The System Just Isn’t Built for You

If you're living paycheck to paycheck, it’s not a failure. It’s a signal.

A 2024 CNBC article said that nearly 50% of Americans were doing the exact same. You’re not alone. You’re not lazy. You’re not doomed. You’re just operating in a world where everything got more expensive, except empathy.

So don’t beat yourself up. Start small. Start today.

Ready to Take Back Control?

Download the Finance360 app and start exploring real-life solutions, from budgeting tools to stress-free planning resources built for how life actually works.

It’s time to make your money work as hard as you do. And this time, you’re the one in charge.

Start your financial journey today with Finance 360!

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users

For Ios Users

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users