Welcome to Finance 360

Know Where Your Money Flows & Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Welcome to Finance 360

Know Where Your Money Flows &

Invest Wisely For Your Long-Term Goals

At Finance 360, we're all about making life better for you. We help you with money stuff and more, so you can reach your goals and be happy. Let's team up to make your dreams come true!

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

Fitness And Wellness

Get fit your way with Finance 360. We're more than just workouts—think personalized tips on food, calmness, and smart advice for feeling your best.

Financial Planning

Make Your Money Work for You. Whether you're saving for something special or planning for the future, we'll create a plan that fits your needs.

Stay Healthy, Stay Wealthy

Keep your mind, body, and bank account in top shape with Finance 360. Learn how to take care of yourself while growing your wealth.

Wealth Tips

We share simple tips & help you save consistently, invest wisely, budget effectively, plan for emergencies, stay informed

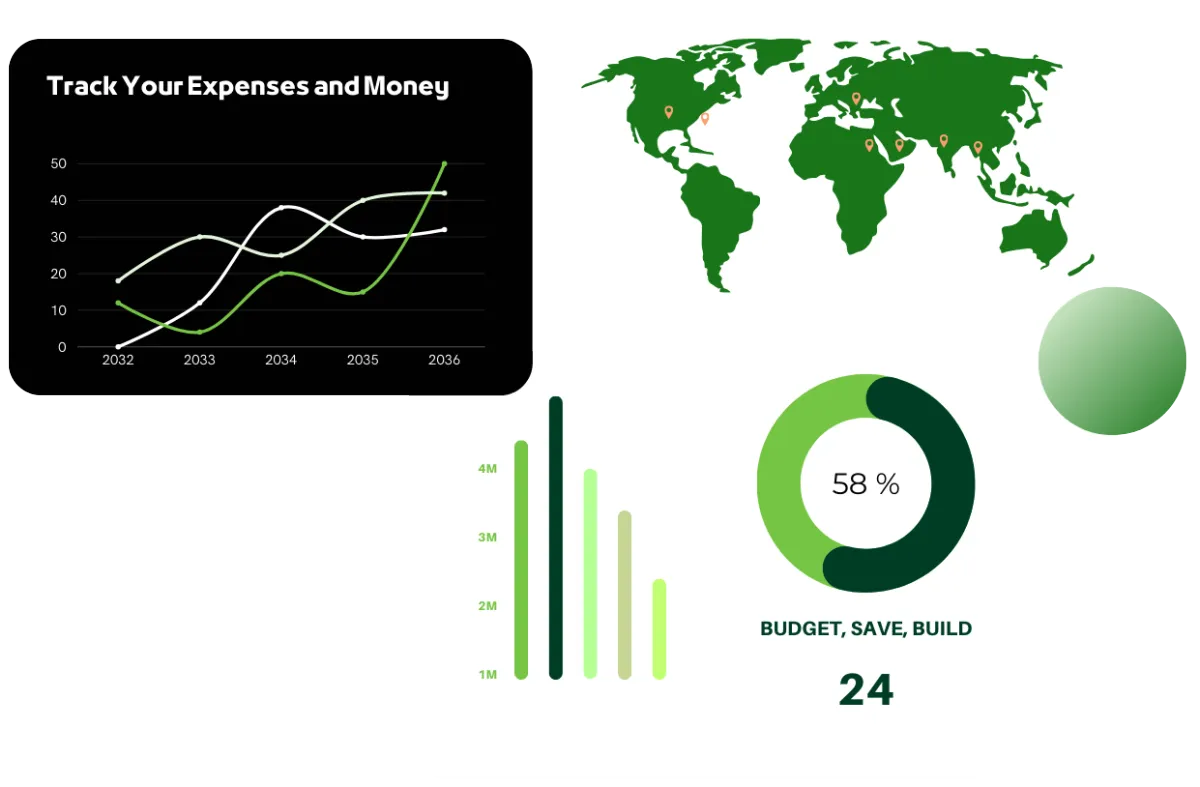

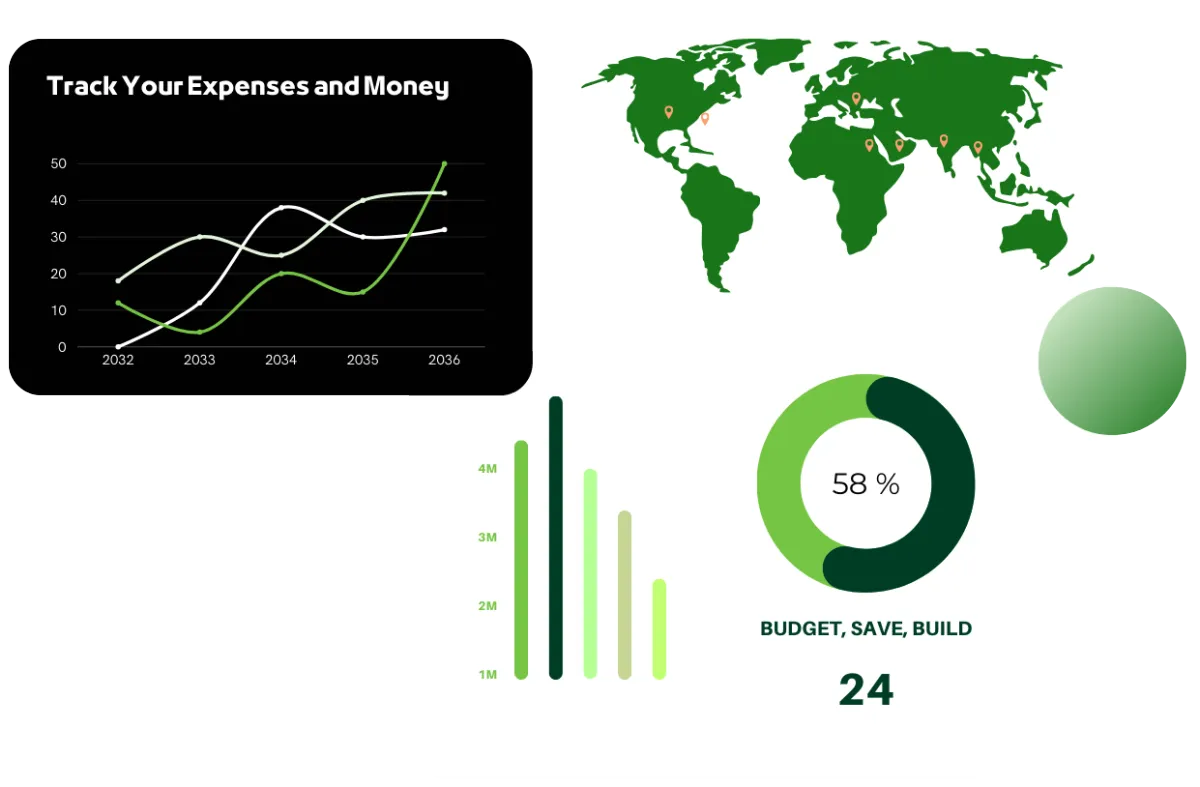

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

How Our Finance App Works

Simplifying Financials

Everything you need is neatly organized in one place, so you can easily keep track of your expenses, set budgets, and reach your savings goals.

Your Financial Companion

Managing your money is a breeze with our app. It gives you tools that are easy to use, helping you plan and track your spending.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

360 Learning

Invest In Yourself, Invest In Your Tomorrow.

Learn more valuable strategies for increasing your savings and spending wisely by exploring our range of informative articles, insightful blogs, and engaging mini courses.

Our 8 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING

& SAVINGS

Building a Strong Financial Foundation

TAX

PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE

PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter financial choices.

Our 7 Pillars

The Foundations We Offer For Financial Success

RETIREMENT PLANNING

Build wealth. Secure your future.

DEBT MANAGEMENT

Mastering Financial Freedom

INSURANCE

Safeguarding Life & Assets

HEALTH CARE

Nurturing Well-being Ensuring Security

BUDGETING & SAVINGS

Building a Strong Financial Foundation

TAX PLANNING

Maximizing Tax Strategies, Minimizing Liabilities

ESTATE PLANNING

Preserving Your Legacy, Protecting Loved Ones With Wills and Trusts

Financial Wellness Education

Empowering smarter

financial choices.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

Benefits

The Best Place For Financial Repair

Membership Savings: Learn smart money moves.

Financial Worksheets: Our workshops break down complex ideas into simple steps.

Financial Analysis Reports: Build a brighter future with us.

Ebooks: Discover financial freedom in our eBook.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this.

6 Smart Ways to Pay Off Credit Card Debt Faster

"Small steps toward paying off debt today can lead to big financial freedom tomorrow."

Paying off credit card debt can seem like a never-ending task, but with the right strategies, you can reduce your balance faster and start saving money. Here are some simple tips to help you pay off your credit card debt:

1. Pay More Than the Minimum Payment

Paying just the minimum keeps you in debt for longer and increases interest charges. Try paying a bit more than the minimum amount every month. Even small extra payments can make a big difference in how quickly you pay off the debt.

2. Consolidate Your Debt

If you have multiple credit cards, consider consolidating your debt into one loan. This can help reduce the number of payments you need to make each month and may lower your interest rate, making it easier to pay off the debt faster.

3. Focus on High-Interest Debt First

If you have multiple credit cards with different interest rates, prioritize paying off the one with the highest interest. This will save you money in the long run, as high-interest debt adds up quickly.

4. Cut Back on Unnecessary Spending

Take a look at your spending habits. Can you reduce any unnecessary expenses? Use the extra money to pay off your credit card debt faster. Cutting back on things like eating out or subscription services can free up cash to put toward your debt.

5. Increase Your Monthly Payments

If possible, try to increase your monthly payment toward your credit card balance. Even an extra $50 or $100 a month can help you pay off your debt more quickly and reduce the interest you pay over time.

6. Transfer Your Balance

Consider transferring your credit card balance to one with a 0% introductory APR. This gives you a period of time to pay off your balance without paying interest. However, make sure to pay off the balance before the introductory period ends.

Additional Tips to Help You Pay Off Your Credit Card Debt:

Use Windfalls to Pay Off Debt: Any extra money you receive, like a tax refund or bonus, should go toward paying off your credit card debt. It can give your balance a big boost in reducing it faster.

Set a Budget: Keeping track of your spending helps ensure you’re not overspending. Stick to a budget that prioritizes paying down your debt.

Consider Credit Counseling: If you're feeling overwhelmed, a credit counselor can help you create a debt repayment plan and manage your finances better.

Conclusion

Paying off credit card debt might take time, but with these simple strategies, you can speed up the process and start saving more. Focus on paying more than the minimum, reduce your spending, and use your extra money to pay down your balance faster.

"Ready to pay off your debt faster? Let Finance 360 guide you every step of the way!"

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users

For Ios Users

Get the App Instantly

Scan the QR Code to Download THE APP

For Android Users